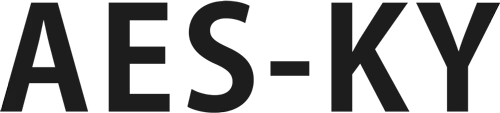

Climate Change Strategy

|

|

Renewable Energy Strategy

|

|

Science-Based Targets initiative (SBTi)

In May 2023, the Simplo Group passed a near-term target review (Note 1), becoming the first company in the global battery modules manufacturing industry to do so. The goal is to reduce absolute GHG emissions by 51% in Scope 1 and 2 compared to the 2020 base year by 2030, and to reduce Scope 3 emissions for purchased goods and services by 25%. In addition, the Simplo Group joined the RE100 initiative in 2024, with the goal of achieving 100% use of renewable energy in operational sites by 2040, and moving towards the goal of achieving Net Zero Emissions by 2050.

|

|

|

Task Force on Climate-Related Financial Disclosures (TCFD)

AES references the core elements of TCFD for disclosing information related to “climate governance, strategy, risk management, and goals”. This helps assess climate-related risks and opportunities affecting business operations, formulate strategies and actions to address climate change, enhance transparency in disclosure, and implement corporate climate governance effectively.

| Core elements | Item | Description |

|---|---|---|

| 1. Governance | (a) Board of Directors supervision methods (b) Management roles |

1. Regularly report on the results to the Board of Directors: he Board of Directors serves as the highest decision-making body for climate risk management, supervising and guiding the Company’s climate strategy and the progress of climate-related objectives. 2. Material issue management: The management regularly reviews climate risk issues, incorporating them into material issue management through the operation of the CSR Sustainability Committee. |

| 2. Strategy | (a) Climate-related risks and opportunities (b) Impact of climate-related risks and opportunities on the organization's business, strategies, and financial planning (c) Climate scenario analysis |

1. According to the internal risk control and management timeline, short-term is defined as 1 to 3 years, mid-term as 3 to 5 years, and long-term as 5 to 10 years. Collect stakeholder needs and climate change issues accordingly. 2. Assess climate change scenarios and evaluate related risks and opportunities based on the TCFD framework. |

| 3. Risk management | (a) Evaluation process (b) Management process (c) Risk management system |

1. Referencing ISO 31000 risk management guidelines, establish a quantitative risk assessment method. Utilize the operation of a risk working group to conduct risk assessments, enabling risk monitoring and management. 2. Risk identification process: (1)Establish a risk working group composed of managers and above from various departments. This group will report its operations to the Board of Directors. (2)Conduct inventory and verification of Scope 1, 2, and 3 GHG every year. (3)Launch product lifecycle inventory and improvement of critical areas. |

| 4. Indicators and targets | (a) Indicators for assessing climate-related risks and opportunities (b) GHG emission volume Goal implementation review |

1. Passed the review of the SBTi (1.5 ℃ near-term) target, using 2020 as the base year, aim to reduce absolute Scope 1 and 2 GHG emissions by 51% by 2030. Additionally, reduce absolute Scope 3 emissions related to “purchased goods and services” by 25%. 2. Joining RE100 and committing to use 100% renewable energy in global operations of Simplo Group by 2040. 3. Conduct annual organizational ISO 14064-1 GHG inventory and verification to review progress towards carbon reduction targets. 4.Continuously engage with suppliers to achieve supply chain management goals. |

Addressing Climate Risks and Opportunities

I. Financial impacts and response to climate-related risks

|

Type |

Climate-related risks |

Potential financial impact |

Response actions |

|---|---|---|---|

|

Transformation risk |

Policies and regulations |

Responding to regulatory requirements leading to increased operational costs |

1. Energy conservation and carbon reduction solutions |

|

Technology |

1. Customers request the use of renewable energy |

1. Low-carbon technology transformation and introduction of low-carbon processes |

|

|

Market |

1. Customer and market demand changes affecting orders |

1. Assessing new markets for green transformation |

|

|

Reputation |

Inability to meet customer or stakeholder expectations leading to revenue decline |

1. Enhancing transparency of disclosure of sustainability information |

|

|

Physical risk |

Immediateness |

1. Decreased production capacity or disruptions (e.g. shutdowns, transportation difficulties, supply chain interruptions) |

1. Enhance emergency response capabilities |

|

Long-term |

Chronic climate change (e.g. average temperature rise/sea level rise) |

1. Enhance emergency response capabilities |

II. Financial impacts and response to climate-related opportunities

|

Type |

Climate-related opportunities |

Potential financial impact |

Response actions |

|---|---|---|---|

|

Resource efficiency |

Improve operational management efficiency |

1. Enhance resource usage efficiency |

Introducing post-consumer recyclable plastic materials (PCR) |

|

Energy sources |

Using low-carbon energy and evaluate participation in the carbon trading markets |

1. Reduce the risk of GHG emissions |

1. Energy conservation and carbon reduction solutions |

|

Products and services |

1. Increasing opportunities for low-carbon products and services |

Harnessing the advantages of new technologies to enhance the performance of various products and achieve market-leading energy efficiency |

Meeting climate adaptation needs through innovative solutions to increase revenue |

|

Resilience |

1. Improve the adaptability and resilience of business operations |

1. Assess supply chain operational capabilities |

1. Increase R&D capacity and continuous innovation |

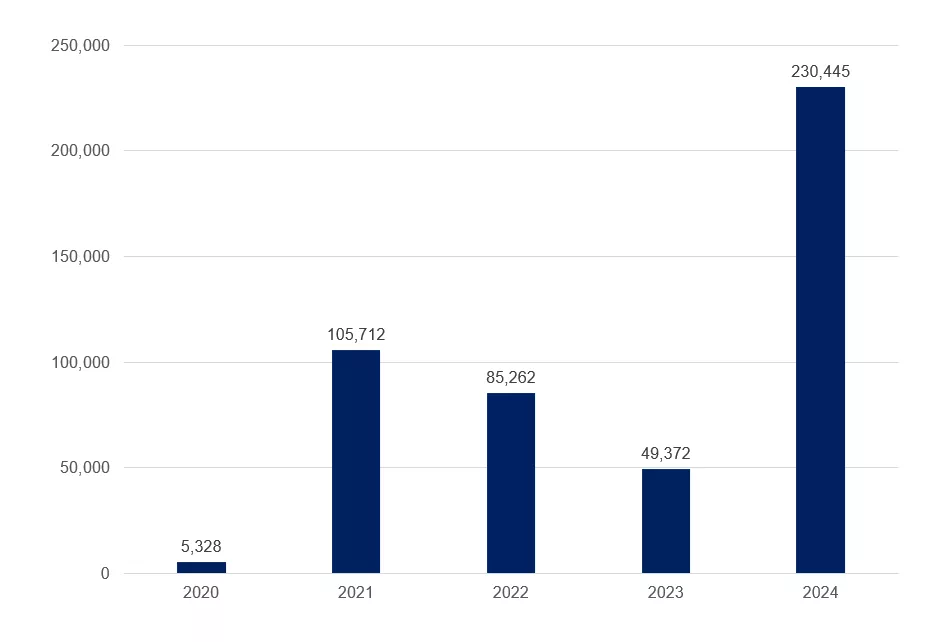

GHG Inventory

AES refers to ISO 14064-1: 2018 GHG inventory standards and guidelines such as the Greenhouse Gas Protocol published by the World Resources Institute (WRI) to establish a GHG inventory mechanism. Since 2019, annual GHG inventory have been conducted at each plant to comprehensively understand GHG emissions. Starting from 2021, these data have been verified by third parties.

Direct and Energy Indirect GHG Emissions (Scope 1 and Scope 2)

|

Year

|

2020

|

2021 | 2023 | 2024 |

|

Direct (Scope 1) GHG emissions

(ton CO2e) |

66

|

148 | 122 | 112 |

|

Indirect (Scope 2) GHG emissions

(ton CO2e) |

7,093

|

8,943 | 3,538 | 1,988 |

|

Total GHG emissions

(ton CO2e) |

7,159

|

9,091 | 3,660 | 2,100 |

| Emission intensity (ton CO2e / NTD million in revenue) |

1.14 | 0.79 | 0.24 | 0.21 |

| Emission intensity (Kg CO2e / PCS) |

5.99 | 4.83 | 1.79 | 1.68 |

Note:

1. The data includes Trend Power, Trend Energy, Trend Power (Changshu).

2. The inventory is done with the operation control. The figures of the GHG inventory are certificated by third-party.

Other Indirect GHG Emissions (Scope 3)

AES has established a GHG inventory and assesses the significance of the items in the C1-C15 categories by GHG protocol. Based on the significance of the analysis results, 7 categories were included in the inventory items, and verified by a third party in accordance with ISO 14064-1.

|

|

| Scope 3 Category | 2024 GHG emissions (ton CO2e) |

| C1 Purchased Goods and Services | 210,041 |

| C3 Fuel- and Energy-Related Activities (Not Included in Scope 1 or Scope 2) | 7,935 |

| C4 Upstream Transportation and Distribution | 2,464 |

| C5 Waste Generated in Operations | 39 |

| C6 Business Travel | 694 |

| C7 Employee Commuting | 822 |

| C9 Downstream Transportation and Distribution | 8,450 |

1. The data includes Trend Power, Trend Energy, Trend Power (Changshu).

2. Including GHG protocol categories 1, 3, 4, 5, 6, 7, 9.

Internal Carbon Pricing (ICP)

Simplo Group applies carbon pricing by using shadow pricing to assume the cost of carbon emissions. This incorporates the cost of carbon emissions and the benefits of emission reduction into investment analysis, serving as a reference for internal investment decisions. This is used to promote various energy-saving projects and establish incentive mechanisms to achieve the company's carbon reduction goals.

Referring to international carbon fees and industry carbon prices, a shadow price range of US$30-50 per metric tonne of CO2 equivalent is set. This serves as an important decision-making reference for the parent and subsidiary companies at the consolidated financial statement boundaries when planning process improvements and energy-saving and carbon reduction projects in Category I (direct emissions) to Category II (indirect emissions). In 2024, AES implemented five actions, saving 32,589 GJ of energy, equivalent to a carbon reduction of approximately 4,858 metric tons. Through the efforts of all employees, Simplo Technology Group reduced its total carbon emissions in Category I and Category II by 88% in 2024 compared to the base year of 2020, achieving the phased carbon reduction target of net zero through SBT.

The IPCC Sixth Assessment Report indicates that limiting global warming to 2°C would require marginal carbon reduction costs of approximately US$90 in 2030 and US$210 in 2050; limiting warming to 1.5°C would require marginal carbon reduction costs of approximately US$220 in 2030 and approximately US$630*1 in 2050.

*1. IPCC AR6 WGIII Chapter 03 (https://www.ipcc.ch/report/ar6/wg3/downloads/report/IPCC_AR6_WGIII_Chapter_03.pdf)

Contact us

Contact us